Review: Raju and the Forty Thieves {RBI Publication (2022)}

Billions of dollars are siphoned off each year by fraudsters. Tips from RBI on staying alert to such scams.

Heard of the Middle Eastern folk tale “Alibaba and the Forty Thieves”? The story revolves around a woodcutter named Alibaba (a fictional character) “who secretly watches as 40 thieves hide their booty in a cave, the door to which can be opened only by the verbal command of “Open, Sesame!” He later uses this magic phrase, steals riches from the cave, and lives a prosperous life. The thieves eventually suspect Ali Baba, and they hide themselves in large oil jars that, with the unsuspecting Ali’s permission, are stored overnight in Ali Baba’s courtyard.

When the slave Morgiana goes to extract oil from one of the jars, she hears a robber whisper. Morgiana realizes that the jars contain not oil but robbers lying in wait to kill her master. She pours hot oil into each jar, thus killing the robbers. Morgiana later saves Ali Baba’s life a second time, and in gratitude he frees her. She marries Ali Baba’s son, and the entire family lives prosperously on the wealth obtained from the cave that only they can enter”.1

In May 2022, the Reserve Bank of India (RBI), published a pictorial series titled “Raju and the Forty Thieves”. Though the title seems to be inspired by “Alibaba and the Forty Thieves” - the lessons of this story are quite different. The series talks about 40 different ways in which financial fraudsters can dupe you of your money within minutes. It is a much-needed document. But before I dive into the core of this document - here is an important takeaway.

Designing a policy/ program with everyone as a beneficiary is a difficult task. There is no specific group at the heart of it. The outcome looks promising but is never guaranteed. Especially in India. Think of the diverse groups/ communities - all of which use the same currency. Retired individuals, vegetable sellers, students, professionals, unemployed, etc. - all belonging to different economic strata, religions, castes, and tribes using the same notes, coins, and mobile applications that you and I do. How would you navigate this mess? This booklet turns out to be a masterclass in design thinking.

As the preface of this booklet notes:

“The booklet is an easily understandable pictorial depiction of incidents happening around us and helps us to learn how to keep hard-earned money and ourselves safe from fraudsters.

As the name suggests, ‘Raju and the Forty Thieves’ contains forty such short stories providing glimpses of fraudulent events being reported to us and provides simple tips about DOS and DONT’S. Raju is a typical gullible citizen, and, in these stories, he appears in different characters, some time as a senior citizen, some time as a farmer, some time as a happy-go-lucky guy, etc., although with same curly hair always to identify with different walks of life.”2

It is no surprise that members of almost every community have had to go through these scams one way or another - be it through an SMS, a call, an ATM, an email, shopping online, or enrolling in fraudulent initiatives offering a handsome amount on work from home or even using public Wi-Fi! A recent Business Standard report noted that the number of such fraudulent activities had increased in 2021-22.

“In 2021-22, frauds to the tune of Rs 60,414 crore were reported, down 56.28 per cent from Rs 1.38 trillion in 2020-21. In terms of number of frauds, these entities reported 23.69 per cent higher frauds at 9,103 in 2021-22 as against 7,359 frauds in 2020-21. The RBI data considers frauds of Rs 1 lakh and above only.”

“While the number of frauds reported by private sector banks were mainly on account of small value card/internet frauds, the fraud amount reported by public sector banks was mainly in loan portfolio”, the report added.”3

Source: Infogram

Such an economic loss - solely due to online scams is bizarre. Yet, the general tendency is to (sometimes, unintentionally) run after the roots of such allure.

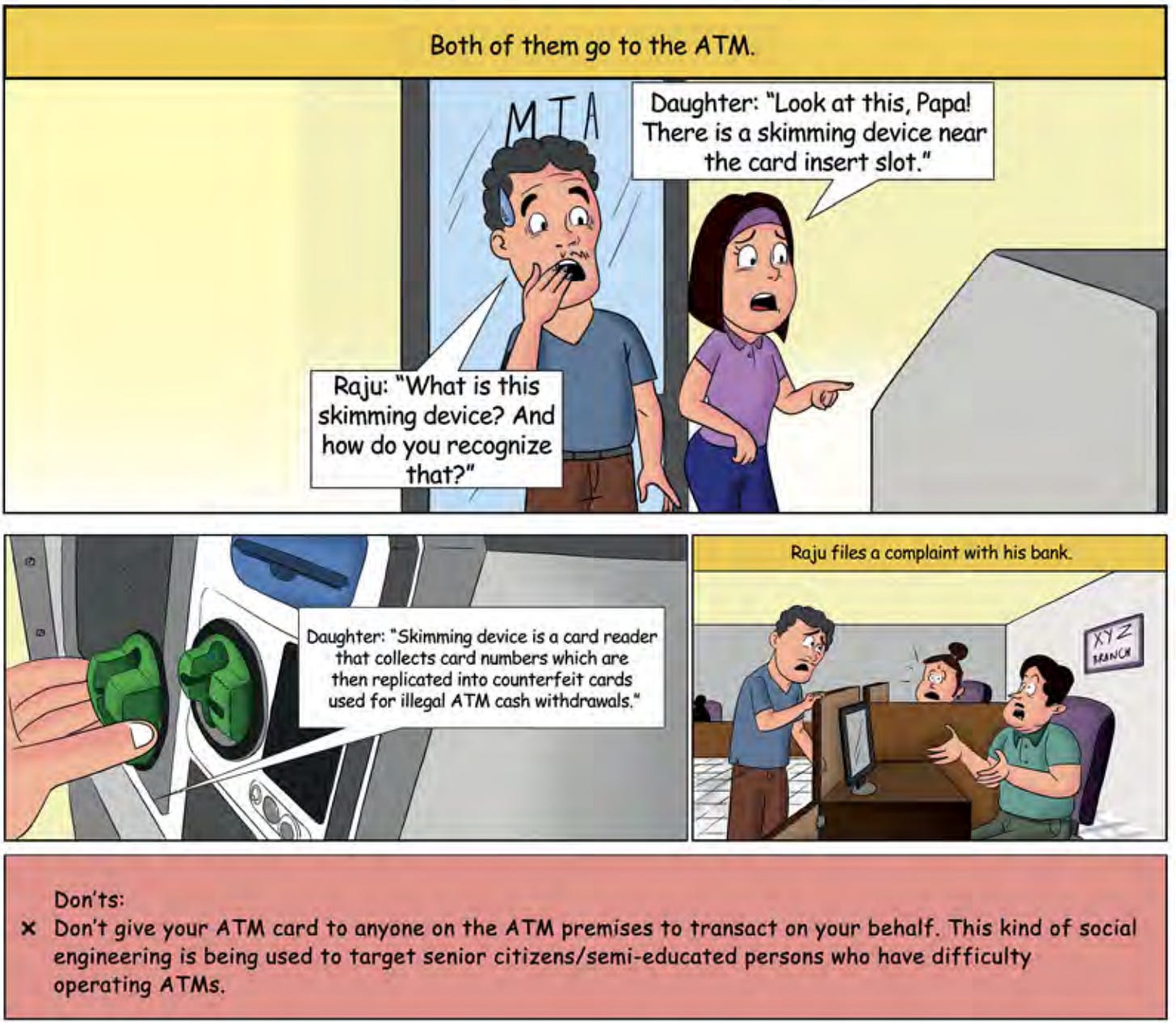

Consider a simpler trick. A “skimming device” in an ATM. The device is “a card reader that collects card numbers which are then replicated into counterfeit cards used for illegal ATM cash withdrawals.” Using such a device a trickster might withdraw [X] amount of cash from an individual’s account without the PIN/ OTP (one-time password) being shared via a message or a call.

Source: Pg. 10, Raju and the Forty Thieves

I, for one, got to know about this trick only when I came across it in this booklet. You see, financial education and digital financial education are topics that must be aggressively studied. Not just because it involves finance, money, and the self-interest of an individual, but because in the years to come, digital banks in India might be a reality.

A recent NITI Aayog report titled “Digital Banks: A Proposal for Licensing & Regulatory Regime for India” brought forth the idea of entirely online banks “expected to work on new technologies and provide services in areas where there is no or less service access.”4 While these digital banks could prove to be the much-needed lightning bolt to financial inclusion in India - unsettled issues on data privacy, cyber-security, frequent internet shutdowns, etc. could hinder the scale of adoption of these banks.

Regardless, continuous financial education is crucial. With what I imagine must have been a Herculean effort involving rigorous rounds of editions, RBI has done a brilliant job with this publication. Would recommend you to give it a read. Imagine flipping through Batman or Archies, Tinkle, Amar Chitra Katha - or your favorite comic - only fine-tuned to saving your hard-earned money at any cost. Interested?

Britannica, T. Editors of Encyclopaedia. "Ali Baba." Encyclopedia Britannica, December 12, 2014. https://www.britannica.com/topic/Ali-Baba.

Raju and the Forty Thieves, Office of the RBI Ombudsman (Mumbai-II), Maharashtra and Goa, URL: https://www.aubank.in/raju_and_40_thieves-rbi_ombudsman_mumbai_II_mobile_landscape.pdf

Reporter, B. S. “RBI Annual Report: FY22 Saw More Bank Frauds but Value Decreased by Half,” May 27, 2022. https://www.business-standard.com/article/finance/rbi-annual-report-fy22-saw-more-bank-frauds-but-value-decreased-by-half-122052700468_1.html.

https://www.outlookindia.com/. “What Is A Digital Bank And How It Will Benefit You,” July 27, 2022. https://www.outlookindia.com/business/digital-bank-news-what-is-a-digital-bank-and-how-it-will-benefit-you-news-212287.

Very rightly argued, we need to read and learn, how people commit frauds to save ourselves from such uninvited mishaps of digital World. Very good