BNPL: Gateway to a Better Lifestyle?

Guest Post by Monica Sonkusare

India has seen astounding growth in the e-commerce industry in the last few years. This boom has covered “close to 100% of pin codes in India” in e-commerce adoption.1 With time, businesses - large and small, have had to adapt their business models to the Internet economy to gain & retain clientele. However, an enticing new ‘Buy-Now Pay-Later (BNPL)’ framework has disrupted this ecosystem. By the sound of it, budgeting monthly expenses is no longer a worry. That iPad you wanted? Or, the new Apple Vision Pro? With bank account restrictions gone, that could land right at your table soon.

Too good to be true, huh? Put simply, a BNPL model offers a credit line wherein the service provider gives you a limited amount of money to make an expense, and the customer pays back the consumed amount in full or in installments. You could avail this from your credit card as well, however, the key difference between a BNPL model and a credit card is the joining process and its eligibility. A credit card has a complicated joining process in which you submit documents and might also have to visit the bank, whereas the process of BNPL is completely digitalized and is completed within minutes.

Financial Inclusion of the Informal Economy

The appeal of BNPL applications lies in their user-friendly interfaces, seamless integration with e-commerce platforms, and instant loan approvals. This combination has acted as the perfect recipe to attract prospective consumers who had not been a part of the formal economy before. Customers appear to complete a purchase more frequently and for larger dollar amounts when merchants offer it on the BNPL model.

And so far, this BNPL model has soared in India. As of 2022, LazyPay is seated at top-of-the-charts with ~39% of the total GMV (Gross Merchandise Value - a metric used to determine the total value of a company’s sales over a given period) despite the presence of providers backed by some of the major firms such as Simpl, ZestMoney, PineLabs, Paytm Postpaid, Unicard, Slice, OlaMoney Postpaid, Amazon Pay Later (Capital Float), and Flipkart Pay Later.2

Soaring Adoption Rates (₹)

With the big e-commerce companies also riding this wave, the Indian e-commerce industry has garnered ~230 million (23 crores) users in India (as of 2022).3 While BNPL users made up only a fractional 10% of this number in 20214 - the number of users is expected to reach 202 million (20.2 crores) by the end of FY2023-24, with total transaction volume skyrocketing at a CAGR (Compound Annual Growth Rate) of 67% since inception (2017-2018) to 2 billion USD (200 crores) by FY 2025-26.5

But, the devil is in the details…

What seems to be an assured formula to market products to the masses & sure-shot ticket to get you that Apple Vision Pro with ease - BNPL apps bring more challenges than benefits to customers, providers, and merchants. Let me break that down.

Merchants would offer you credit at point-of-sale (Amazon, Flipkart, Paytm etc.) and take on credit risk along with associated administrative costs.

BNPL Service Providers (such as LazyPay & Simpl) take the most risk of non-payment by customers when paying the merchants at the time of transaction.

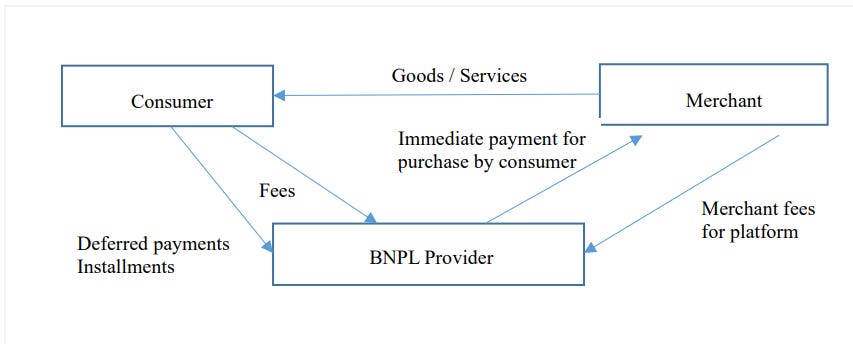

The BNPL Business Model

BNPL service providers make money by charging a fee to merchants. This fee is the difference between the amount the provider pays the merchant and the amount the provider collects from the customer.

Merchants subsidize their customers through this financing option to boost sales and facilitate higher-value transactions. For example, Zomato offers discounts if you pay using the Simpl app. The fees charged by BNPL providers are publicly disclosed and typically range from 2.5% to 12.5% of the gross merchandise volume (that is, the sales price of products multiplied by the number of products sold).6

The BNPL House of Cards

While business models are perfected over time - so far, these appear to be translating into a wave of losses. The core issue: These BNPL firms spent more on acquiring customers than generating revenue. Consider the case of Zest Money.

While the company claimed to have 17 million subscribers in 2021, subject to shaky business strategy and a string of loan defaults - it is facing a gutting cash crunch today.

ZestMoney’s customer acquisition cost (CAC) in the form of cashback and other perks skyrocketed to as much as ₹ 1,000 per customer. In this scenario, ZestMoney incurred a debt rate of above 13% (a relatively healthy BNPL loan default rate is considered to be at 2-3%).7

This triggered banks and NBFCs (Non-Banking Financial Institutions) to back out from giving any further credit lifeline to Zest Money.

So, what should you and I do?

Stick with applying for loans from banks and other traditional financial institutions? Well, these institutions consider this question entirely on an individual’s credit score. For instance, since tech-savvy (and the prime market for BNPL applications) Gen Z and millennial consumers, are often first-time borrowers & chances are, they will not be granted a credit card or a loan unless their guardians/ parents provide a guarantee to the bank.

BNPL providers see this as an opportunity & exploit this gap between credit card holders and those who don’t or cannot. Incidentally, in India, that is a very large pool.

This lucrative model has changed consumer behavior significantly. Impulsive purchases have increased and users are no longer bound by immediate payment requirements. The convenience and ease of accessing credit through BNPL apps can potentially lead to overspending and debt accumulation, particularly for users who do not have a disciplined approach to managing their finances.

With access to 10 or more BNPL providers and unlimited wants, if not used responsibly, BNPL applications can conjure financial hardships for individuals and even trigger a cycle of debt. This has also been evident in overseas markets. For instance, one in three US citizens who utilize BNPL services has reportedly missed one or more payments. Among them, 70% of the consumers reported a drop in their credit scores.8

But, market innovations are on the way..

To enable consumers to maintain their credit scores and yet avail BNPL model’s convenience and flexibility, the market is beginning to mould itself to customer requirement.

For instance, after observing a large number of users facing debt accumulation due to BNPL applications - fintech firms have constructed the ‘Save Now, Buy Later’ - SNBL concept. Here, the service provider asks you to plan and save for future expenses. This is a brilliant ‘nudge’ for users to be financially literate - and understand the terms and conditions thoroughly before opting to be a part of any credit line.

Regulatory Outlook

The Reserve Bank of India's (RBI) recent regulations have had an eye towards higher supervision and licensing of fintech products.9 10 For instance, in June 2022, RBI issued a notice to fintech companies which offer services of using online wallets, prepaid cards and online accounts (examples - GooglePay, PhonePe, and Paytm) to not let their users recharge their wallets and cards by utilizing credit lines.

While these regulations will help lenders and service providers, the service providers may face to a difficult time balancing between the regulations, as well as, providing consistent convenience to the customers.

Perhaps then, stakeholders across the fintech ecosystem must design a regulatory framework that gives a much-needed respite to this development in the e-commerce industry.

“E-Commerce Industry in India - Market Size, Opportunities, Growth.” Accessed June 14, 2023. https://www.investindia.gov.in/sector/retail-e-commerce/e-commerce.

“India Buy Now Pay Later Market Outlook to 2026: Ken Research.” Accessed June 15, 2023. https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-buy-now-pay-later-market-outlook-to-2026/515064-93.html

“India Records over 100 Million New Online Shoppers between 2020 and 2022” Accessed June 15, 2023 https://apparelresources.com/business-news/retail/india-records-100-million-new-online-shoppers-2020-2022/#:~:text=Between%202020%20and%202022%2C%20India

“Buy Now Pay Later the Future of Credit.” 2022. https://benoriknowledge.com/wp-content/uploads/2022/04/Buy-Now-Pay-Later-Report.pdf.

“The Indian Payments Handbook – 2021–2026.” n.d. Https://Www.pwc.in/Assets/Pdfs/Consulting/Financial-Services/Fintech/Payments-Transformation/The-Indian-Payments-Handbook-2021-2026.Pdf

“What Is the Future of Buy Now, Pay Later (BNPL) in India?” 2023. Paytm Business Blog. January 3, 2023. https://business.paytm.com/blog/future-of-buy-now-pay-later-in-india-ft/.

“What Broke ZestMoney – How India’s BNPL Poster Child Lost Its Zest.” Inc42 Media. June 8, 2023. https://inc42.com/features/what-broke-zestmoney-how-indias-bnpl-poster-child-lost-its-zest/.

“BUY NOW PAY LATER: A REVOLUTION CHALLENGED in INDIA.” n.d. 8: 810. Accessed June 15, 2023. https://www.ijrti.org/papers/IJRTI2304135.pdf.

The Economic Times. n.d. “RBI Making Life Tougher for Fintech Firms: Report.” https://economictimes.indiatimes.com/tech/technology/rbi-making-life-tougher-for-fintech-firms-report/articleshow/92378914.cms?from=mdr.

Vijay, JSA-Kumarmanglam, Nikhil George, Pratish Kumar, Probir Roy Chowdhury, and Yajas Setlur. 2022. “First-Step Analysis: Fintech Regulation in India.” Lexology. August 12, 2022. https://www.lexology.com/library/detail.aspx?g=5478a681-cae6-4794-9d8e-ec8e5134625a.

Very good analysis. BNPL has been very popular facility in department of Posts for Bulk customers.